United States President Donald Trump, Eli Lilly, and Novo Nordisk have announced a deal to reduce the prices of popular GLP-1 weight-loss drugs for the government’s Medicare and Medicaid programs, as well as for patients paying out-of-pocket. The agreement, unveiled on Thursday, aims to enhance access to these treatments for millions of Americans, particularly those aged 65 and older who rely on Medicare, and low-income individuals covered by Medicaid.

The initiative seeks to address the high cost of prescription medications in the U.S., where patients often pay three times more than in other developed countries. Trump emphasized that the deal would “equalise the world,” with both companies providing medications to Medicaid at “most-favoured-nation” prices. However, the event was cut short when an attendee collapsed in the Oval Office.

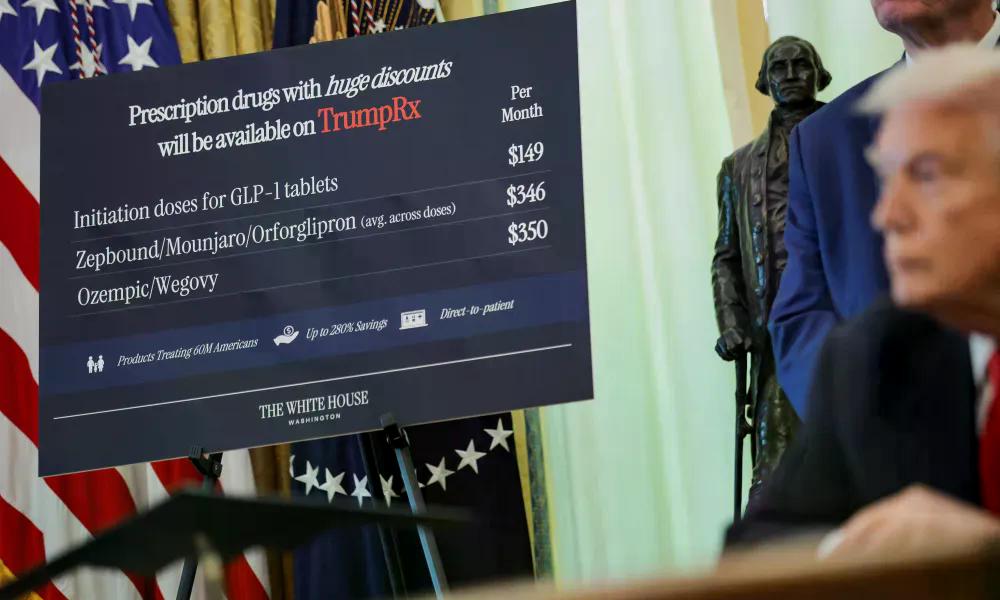

Under the new arrangement, starter doses of rival weight-loss pills being developed by Lilly and Novo will be priced at $149 per month for all Medicare and Medicaid enrollees, as well as through the White House’s direct-to-consumer platform, TrumpRx. For currently available injectable GLP-1 drugs used for diabetes and related conditions, monthly costs will be reduced to $245 for Medicare and Medicaid patients.

Patients using the TrumpRx platform will see average prices for injectables and pills starting at or below $350 per month, with expectations of further reductions to $245 within two years. Lilly has also committed to offering the lowest dose of Zepbound at $299 per month, with higher doses priced at $449 for cash-paying patients.

Medicare beneficiaries will have their co-pays capped at $50 per month, while commercial health insurers can expect prices up to 25% lower than current cash rates. The government will also expand coverage of GLP-1s under the deal, including overweight patients with prediabetes, heart problems, and severe obesity—accounting for 10% of Medicare patients. This marks a significant shift, as Medicare typically does not cover weight-loss drugs for obesity, and Medicaid coverage varies by state.

The agreed prices will take effect no later than January for cash payers, by mid-2026 for Medicare patients, and on an ongoing basis for Medicaid enrollees depending on state participation. As part of the deal, the companies will receive relief from tariffs, with Lilly exempted for three years. Novo and Lilly will also gain fast-track regulatory vouchers for future drug approvals.

Wegovy and Zepbound are the leading GLP-1 weight-loss drugs in the U.S., sold as weekly injections. Their list prices exceed $1,000 per month, though both offer a $499 monthly supply for cash buyers. Novo Nordisk has pledged an additional $10 billion investment in the U.S., according to a White House fact sheet.

Lilly stated that the agreement will improve access to medications for nearly 40 million Americans covered by government insurance programs, as well as millions who pay out-of-pocket. The company plans to add its diabetes medications—Emgality, Trulicity, and Mounjaro—to its direct-to-consumer platform, offering them at 50% to 60% below current list prices.

Analysts at Deutsche Bank view the deal as a potential growth driver for Lilly, estimating that a $150 monthly cap could unlock access for up to 15 million Americans for its experimental weight-loss pill, orforglipron. The bank noted that increased uptake could come from the 20% of obese adults preferring oral medications over injections. Currently, about 2.7 million Americans use Lilly’s injectable Zepbound.

Lilly and Novo are competing to bring oral GLP-1 treatments to market. Novo’s once-daily oral Wegovy is under FDA review, with a decision expected later this year, while Lilly’s orforglipron is set for regulatory submission by year-end and a potential launch in 2026.

BMO Capital analyst Evan Seigerman highlighted Lilly’s growing dominance in the GLP-1 space, noting increased physician and patient preference for its drugs. Pfizer and AstraZeneca have also signed new pricing agreements tied to the TrumpRx platform.

On Wall Street, Novo Nordisk stock fell 3.6% since the market opened, while Eli Lilly remained relatively flat, rising just 0.03%. Pfizer and AstraZeneca saw gains, with shares up 1% and 3.4%, respectively, as of 2 p.m. in New York (19:00 GMT).